High Premiums for COE - The Real Culprits?

Recently, there have been calls to revise the COE bidding system such that private companies bid in a separate category. At present, they compete with regular people and also manage to successfully secure plenty of COEs for their corporate fleets given their financial backing.

Ironic ads such as this are a clear indication that there is a vision to put as many private-hire taxi drivers on the roads as possible. Many regular people would have been able to afford a car without having to do taxi driver roles had it not been for unnecessary fleet purchases keeping COE premiums at inflated levels for the past few years.

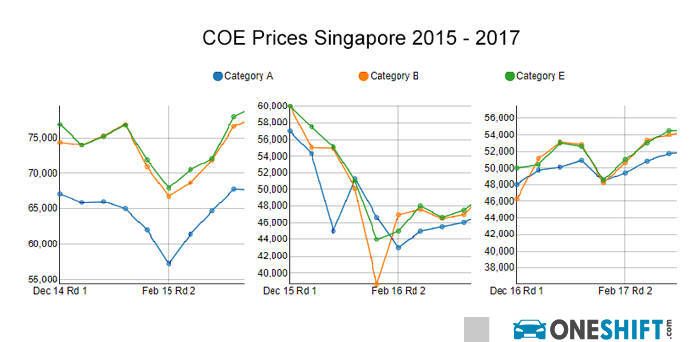

A drop of $6000 - $8000 is what we have become accustomed to as indicative of “low COE”. The current drop is very similar to the drops we have had in previous years right before Chinese New Year.

The COE premiums seem to drop right before Chinese New Year before picking up again.

However, the COE is honestly still high – costing almost as much as some cars. That’s an unnecessary financial burden that most who want cars will have to carry upon purchase for the next 5 to 7 years.

Recently, there have been calls to revise the COE bidding system such that private companies bid in a separate category. At present, they compete with regular people and also manage to successfully secure plenty of COEs for their corporate fleets given their financial backing. For example, one of Singapore’s largest private-car rental companies – Lion City Rentals had, since its inception in 2015 to Dec 2016, purchased a huge fleet of 14,000 cars. Assuming an average $50,000 in COE premium per car it is no surprise that in slightly over a year, it had already chalked up a billion Singapore dollars in debt.

However, it is not alone. BlueSG, an electric car-sharing company, launched in Dec 2017 with 80 cars and plans to roll out another 920 cars eventually. That makes an additional 1000 COEs that will be bid against the regular car buyer. Short-term rental car companies such as Tribecar and Smove also have expanded their car fleets.

Is there really such high demand for car-sharing all of a sudden? Or high demand for taxis? Was it all really necessary to buy up so many cars and inadvertently drive up the COE premiums?

With so many new COEs snapped up, along with cars for rent – there was a great push to become part-time drivers to drive all these cars and make money. In the initial stages, there was much excitement, plenty of sign up bonuses, cheaper rental versus regular taxis and incentives for minimum rides.

Taxi drivers were quick to jump ship and increase their earnings. However, as regular people started to join the boom – retirees, the jobless and part-timers, competition grew strongly and there was generally an oversupply of private hire taxis.

Soon just about anyone was encouraged to become a private-hire driver. Even expensive click-ads to join ride-hailing apps as a driver spammed just about any website and social media platform imaginable.

Due to such unnecessary fleet expansion on borrowed money from banks, new cars with fresh COEs were sitting idle in the lot and depreciating with insufficient drivers to keep them running on the roads.

The bubble in the private-car rental market has already begun to burst, yet the buying has not really stopped. If car prices remained high enough, it might actually be possible that people who really need cars will eventually succumb to using car-sharing services.

If getting sufficient drivers to drive these over-purchased cars is a problem, eventually the car buying will either plateu or stop. There is only so much you can do in a small country with a limited population and road space. If car-share companies start to trickle into debts with no clear profit-making solutions – it will be difficult to obtain fresh funding. Demand for private-hire car rental is going down, and likewise – should car-sharing not gain sufficient traction and become unprofitable – both will eventually cease buying and provide reliefs in COE premiums.

The high number of private-hire taxis on the roads today is actually a peek into the near future when autonomous cars would ply the roads doing the same thing. With the ride-hailing apps established, driver and commuter information are continually being analysed to improve efficiency. By knowing when people need rides, traffic information, passenger pick-up and destination points, taxis will be able to maximize their time on the roads. The entire system will be primed and ready for autonomous cars.

Once cars are able to drive themselves, there is no end to private companies buying them. There is probably no need for private-hire companies either. Automakers today are buying big stakes in ride-hailing companies to be able to provide transport solutions to customers without having to get them to purchase their vehicles traditionally.

Regular buyers waiting to buy an autonomous car for personal use will definitely be given the option of allowing their cars to “work” for them as taxis when not needed. In fact, it then becomes far more expensive to purchase a vehicle exclusively for own-use.

It is somewhat acceptable that high COE premiums were driven by private hire companies because once there was a clear demand for it and generally people loved having more and cheaper travel options. However, given that many cars were bought but left unused by these companies is regrettable – and could have been better allotted to private buyers who needed cars. There are also plenty of private hire taxi drivers who also jumped on the bandwagon and struggle to make decent money and eventually returned the cars at a loss.

Be it the regular car buyer at the showroom or a corporate entity snapping up many cars, the Certificate of Entitlement (COE)’s ulterior motive is to keep the vehicle population in Singapore in check and that it certainly did achieve. However, Singapore’s auto landscape for now is slowly changing into a city overrun by private-hire taxis - and high COE premiums will go unquestioned for a while.

Credits: Mahindra

Get the Best Price for your used car

from 500+ dealers in 24 hours

- Convenient and Hassle-Free

- Consumer Protection

Transparent Process

With No Obligation