MAS Eases Rules on Motor Vehicle Financing

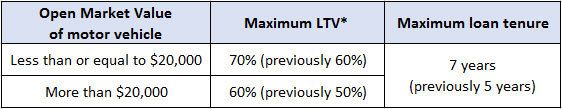

The maximum LTV (loan-to-value ratio) will be raised from 60% to 70% for vehicles with OMV (open market value) less than or equal to $20,000. 50% to 60% for vehicles with OMV greater than $20,000. Maximum loan tenure raised from 5 to 7 years.

The Monetary Authority of Singapore (MAS) today announced that the maximum loan-to-value (LTV) ratios and loan tenure allowed for motor vehicle loans will be eased, although restrictions will remain in place for the long term. The adjustments follow the sustained moderation in Certificate of Entitlement (COE) premiums and in resulting inflationary pressures over the last three years.

In 2013, MAS introduced restrictions on motor vehicle loans by financial institutions, to moderate the demand for cars and COEs and alleviate inflationary pressures. The measures also served longer term purposes: to encourage financial prudence and to support efforts to promote a car-lite society.

Since then, the contribution of private road transport (excluding petrol) to CPI-All Items inflation has eased from +1.3% points in 2011-2012 to -0.5% point in Q1 2016. In addition, outstanding motor vehicle loans have declined by 32% from $14.13 billion in Q1 2013 to $9.55 billion in Q1 2016.

The allowable vehicle population growth rate remains capped at 0.25% per annum. However, COE quotas have expanded in recent quarters alongside an increase in de-registrations.1

Taking these developments into account, the rules on motor vehicle loans will be revised as follows with effect from 27 May 2016:

* LTV is the amount of the loan expressed as a percentage of the purchase price of the motor vehicle. The purchase price includes relevant taxes and price of the COE.

The Ministry of Trade and Industry will apply the revised financing restrictions to non-MAS regulated entities which extend motor vehicle financing on a hire-purchase basis. The Ministry of Law will also require licensed moneylenders to comply with the revised financing restrictions.

Mr Ong Chong Tee, Deputy Managing Director, MAS, said, “In 2013, when we introduced the measures, our immediate aim was to help restrain escalating COE premiums and consequent inflationary pressures. Since then, demand conditions have moderated and it is timely to ease the measures. MAS will, however, continue to have the LTV and loan tenure framework in place for the long term to promote financial prudence and help support the promotion of a car-lite society.”

Credits:

Get the Best Price for your used car

from 500+ dealers in 24 hours

- Convenient and Hassle-Free

- Consumer Protection

Transparent Process

With No Obligation